Civilisation’s gold: first-ever mapping of the urban mining potential to 2040

© plainpicture/Christian Vorhofer

Germany is a major consumer of raw materials, but is almost entirely reliant on imports of many key industrial minerals, the exceptions being potassium and magnesium products. And yet we are surrounded by vast amounts of valuable materials. So why not utilise the wealth of resources that we have accumulated right on our doorstep? Known as the anthropogenic material stock, this pool of raw materials has been created by human activity. It includes office and residential buildings, vehicles, wind turbines and refrigerators, washing machines and computers. The term used to describe this process of recycling and recovering raw materials from the anthropogenic material stock is “urban mining”. But how large is the anthropogenic material stock in Germany, and how much is it likely to increase? This has now been calculated by a team of researchers from Oeko-Institut, ifeu and ifu Hamburg , who have also produced a forecast of the realistic potential to obtain secondary raw materials from urban mining to 2040.

This is the first study to investigate the anthropogenic metals stock in Germany. A research team from the Oeko-Institut analysed the material flows and recovery paths of seven metals and alloys and mapped their potential for urban mining. To that end, the researchers developed a computational model, collected data and discussed the results with experts at various workshops. The aim was to create a systematic knowledge base for urban mining as a contribution to further developing the circular economy into a resource-conserving material-flow economy.

The following base and special metals were mapped:

-

aluminium (non-ferrous metal)

-

magnesium (non-ferrous metal)

-

zinc (non-ferrous metal)

-

tin (non-ferrous metal)

-

stainless steel (non-ferrous metal)

-

brass (alloy)

-

neodymium-iron-boron magnetic materials / rare earths (alloy).

With the exception of aluminium, the anthropogenic material stock is set to increase by around one-third over the next 20 years to 2040; the same applies to output. The volumes at the three destinations of recycled materials will follow the same trajectory, however: a substantial proportion will be exported, while the percentage left in Germany will remain unchanged. Only the material losses in recycling will not increase at a comparable rate, due to continuously improved accuracy in the techniques applied.

It is important to progressively secure the growing anthropogenic material stock and its recycling potential for the domestic recycling industry. However, energy prices, human resource costs and regulatory provisions mean that Germany is now less attractive as a location for the metals industry than it was several decades ago. This has reduced capacities for the production of various primary and secondary metals, with the result that scrap can no longer be recycled in Germany and must now be exported.

The volume of secondary raw materials – also known as recycled content – that will potentially be available depends on the following factors:

-

output, i.e. the amount and quality of raw materials recovered,

-

how much material is lost during recycling,

-

and how much is exported.

Method: quality criteria, spoilers and volume flows

The materials were examined to determine their recyclability. The following question was considered: which qualities must be achieved to enable this content to serve as a substitute for primary materials? In addition, further potential uses of the recycled/secondary raw materials were identified. This topic was discussed with all stakeholders in order to identify critical value creation stages in which external influences may adversely affect the quality of secondary raw materials. The following organisations were involved in this process: the German Federal Association for Secondary Raw Materials and Waste Management (BVSE), the Federal Association of German Steel Recycling and Disposal Companies (BDSV), the German Copper Institute (Deutsche Kupferinstitut – DKI), Aluminium Germany and the German Non-Ferrous Metals Association (Wirtschaftsvereinigung Metalle), as well as brass manufacturers and researchers from various universities. Problems were identified and potential solutions were developed. Furthermore, a volume-flow forecast was produced, which included modelling of future developments such as electromobility. The return flow of materials from the anthropogenic material stock back into the economic cycle and the effect of recycling on losses were illustrated.

Results

The following comments relate solely to the flow of base and special metals, specifically stainless steel, brass, zinc, tin, aluminium, magnesium and rare earths in magnets (neodymium-iron-boron magnets). The nine sectors listed below feed the anthropogenic material stock in Germany:

-

-

technical goods in building construction (residential and non-residential), e.g. handrails, lifts, metal window frames

-

mobile goods in buildings (excluding electrical appliances), e.g. cutlery, metal sculptures, metal suitcases

-

mobile goods in buildings (electrical appliances), e.g. computers, smartphones, kitchen appliances

-

power generation plants, e.g. wind energy/photovoltaic systems and coal-fired power plants

-

power grids, e.g. transmission and distribution lines and pylons

-

vehicles, e.g. cars, trucks, rail vehicles, ships

-

transport infrastructure, e.g. crash barriers, bridge railings, traffic lights

-

industrial plants, e.g. distillation columns, stainless steel tanks

-

machines, e.g. excavators, cranes, rolling mills.

-

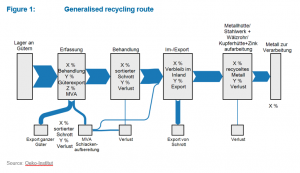

The recycling paths for the various goods and the metals they contain vary considerably. The following figure shows all the transitions considered.

-

As shown, the recycling path begins with the outflow from the goods warehouse.

-

The first step is to collect the metal flow, which is divided into treatment, export and waste incineration. In this step, diffuse losses of between 5% (buildings, infrastructures) and 20% (electrical appliances) occur. The export of whole goods is mainly relevant for vehicles and machinery. It ranges from 0% (buildings, infrastructure) to 60% (vehicles). Waste incineration is relevant for mobile goods such as cutlery and electrical appliances. The efficiency of slag treatment (residues from waste incineration) ranges from 0% (tin) to 56% (aluminium, stainless steel, brass), depending on the metal.

-

During treatment, the goods are separated into individual metals or metal mixtures. Here, comminution technologies are utilised, which have a major impact on vehicles and mobile goods in particular. Losses of between 1% (tin in wind turbines) and 75% (tin in vehicles) can occur.

-

The export of processed scrap varies considerably and ranges from 0% (brass) to 95% (stainless steel). Metal-specific recovery processes have an efficiency between 65% (tin) and 95% (other metals). Examples are the copper smelter for brass, where copper and zinc compounds are recovered; the steel mill and rolling mill for galvanised goods; and the recovery of magnesium as part of the recycling of aluminium alloy, where the alloy is recovered and not the metal separately. From these transitions, the metal quantities found at the three destinations – exports, recycling in Germany and losses – are calculated. Export of metal flows (in whatever form) from the anthropogenic stock means that, in most cases, the recycling of the metals takes place in other EU countries.

The metal stocks

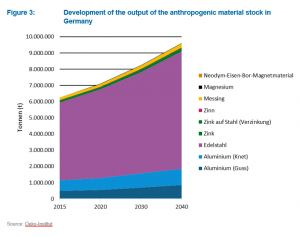

The stocks of the individual metals differ considerably in their orders of magnitude, as they depend on the fields of application. While stainless steel, with around 94 million tonnes in the starting year (2015), takes the top position within the metals/alloys examined since it has many fields of application, the stocks of tin (approximately 67,000 tonnes in 2015) and neodymium-iron-boron magnetic material (just under 34,000 tonnes in 2015) hold the two lowest positions. Tin, for example, is mainly used in electronics and as a bearing metal, while neodymium-iron-boron magnetic material is primarily used in permanent magnets for electric motors and generators. The strong expansion of the application fields (electronic devices, electromobility and wind turbines) is expected to lead to substantial growth of the stock by 2040. For tin, the stock is projected to double, while stocks of neodymium-iron-boron magnetic materials are expected to triple. The stock of other materials has largely stabilised and is increasing at the German economy’s average growth rate of around 2% per year or around 50% over 25 years. The development of the stock in Germany (in tonnes) is shown in the figure below.

Output: the volume of secondary raw materials after recycling

It is not only the anthropogenic stock of all the metals/alloys considered that is expected to grow in Germany between 2015 and 2040. The flows consigned to recycling are also set to increase; the potential of urban mining will therefore be significantly greater in the future than it is today. The development of the output – in tonnes per year – is shown in the figure below.

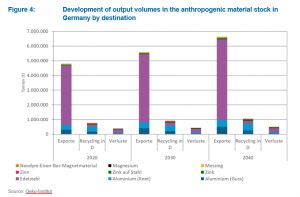

Recycled materials from Germany: what remains here and what is exported?

Alongside direct output, the paths taken by the various flows are particularly important. Each metal has a different recycling path and is distributed differently to the destinations.

-

Rather more aluminium is exported than recycled in Germany; this is due, on the one hand, to the export of scrap and, on the other hand, to the export of used cars and machines in particular.

-

Stainless steel is mainly exported directly as scrap metal; currently, export is also the predominant route for goods that contain brass.

-

Zinc and magnesium are exported and recycled in Germany to an equal extent.

-

Zinc on steel and tin are mainly recycled in Germany.

When it comes to absolute quantities, however, it is, above all, the recycling of aluminium in Germany that stands out (Figure 4). There are currently no adequate recycling routes or a recovery structure for rare earths; however, there is certainly scope to unlock this potential in future. The destinations and associated metal volumes are shown in the figure below.

Problems and possible solutions

It appears that external trading of various metals can have highly diverse impacts on the availability of recyclable secondary raw materials in Germany. World market prices of metals and the quality of scrap can change the direction of material flows here. The optimisation potential in metal recycling can be unlocked most effectively by technical upgrading measures, such as improved detection of scrap metal using modern spectroscopic techniques in automated sorting processes. Scrap aluminium, brass and zinc exhibit a high level of inhomogeneity, so pre-sorting must be improved in order to prevent losses of alloy components. Potential purchasers’ quality expectations are set to rise at the same time. Introducing these innovative processes requires substantial investment, so support in the form of tax concessions or depreciation allowances is recommended. The “zero pollution” philosophy in the product sector is a further obstacle, as it can bring entire recycling loops to a standstill. In order to prevent this from occurring, a more effective and continuous dialogue between the competent authorities, agencies and business stakeholders in Germany is required. Please refer to the final report for further details of these and other potential solutions.

The project

The project “KartAL III – Mapping of the Anthropogenic Material Stock III – Establishment of Material Flow Management with the Integration of Recovery Chains for the Qualitative and Quantitative Increase of the Recycling of Metals and Mineral Building Materials” was conducted over a four-year period on behalf of the German Environment Agency (UBA).

Dr Winfried Bulach and Dr Matthias Buchert are metal recycling experts in the Resources and Transport Division at the Oeko-Institut’s Darmstadt office. Felix Müller is a research officer at the German Environment Agency (UBA) in Dessau.

Further information

https://www.oeko.de/publikationen/p-details/kartierung-des-anthropogenen-lagers-iii-kartal-iii

https://www.oeko.de/publikationen/p-details/stadtgold-metalllager-mit-zukunft

https://www.oeko.de/publikationen/p-details/city-gold-metal-stocks-with-a-future